A credit score is a three digit number that symbolizes a consumer’s ability to repay or satisfy loan/credit payments. The credit score is the figure used by lenders to gauge a consumer or prospective borrower’s risk.

An individual’s credit score is calculated based on their credit history, amount of available credit, amount of hard inquiries (consumer’s attempts to open lines of credit), the types of accounts open and a debt to credit ratio.

A consumer who satisfies their loan agreements (pays bills on time and has a low debt to credit ratio) will have higher credit scores than those consumers who are habitually late with their payments, have high debt to credit ratios or have a history of defaults.

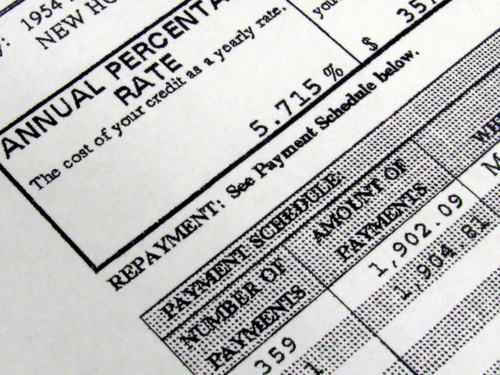

A credit score is the fundamental calculation used by a lender (bank, Credit Card Company, Mortgage Company, auto seller etc.) to gauge a consumer’s ability and willingness to repay their loans. As a result, an individual’s credit score will serve as the qualifying test to secure a line of credit; a lender will not offer financing to an individual with a poor credit score, or will do so with unfavorable variables (interest rates, repayment timeframe etc.) attached.

In the United States, average credit score is 678. This figure is derived from the three credit reporting agencies (Experian, TransUnion and Equifax) in the country. To calculate a credit score, these agencies will take payment reports—sent by lenders—to elucidate a consumer’s specific repayment plan. The table below will list credit scores and the generic characteristics attached to each:

A Credit Score Above 800 is an excellent score; these individual will qualify for the interest rate and loan terms

A Credit Score between 730-799 suggests solid credit management; the individual will likely be approved of loans or lines of credit with favorable interest rates

A Credit Score between 680-729 is regarded as a good credit score; these individuals will qualify for most loans/lines of credit with good interest rates.

A Credit Score between 620-679 is regarded as an average credit score; these individuals may qualify for loans or lines of credit, but the interest attached will be high

A Credit Score between 500-619 is considered a bad credit score; these individuals will have a tough time securing a loan or line of credit. If credit is extended, the terms attached will be unfavorable.

A Credit Score below 499 represents severe risk; these individuals will be rejected for lines of credit or loans—if accepted the attached interest rates will be exorbitant.